This BFSI Marketers Guide will give you all the knowledge about the following :

- Why is integrated Marketing Automation a necessity and not optional in today’s times?

- How can the BFSI sector benefit from the integrated Marketing Automation Platform?

- How to use the data and analytics to bring out the results and create a huge impact?

Let’s get started.

Any successful business or company can appropriately define that the only thing that is constant in their journey with the customers was inconsistency. In today’s time when the attention span is shrinking, and the customer’s journeys across many touchpoints in the digital landscapes are usually parallel, the people seem to come face to face with a new disruption now and then.

Hence, in today’s time, the only differentiator among the companies in the marketplace is the consumer experience.

The only thing that different businesses do to outpace their competition is to grasp the attention of the consumer and engage them effectively.

The Banking, Financial Services, and Insurance (BFSI) sector are not left behind in this digital race. It is not uncommon to see multiple successful BFSI services being replicated within a few days or weeks. This is the speed at which the business is changing, and this is the speed at which the companies need to bring changes to them. The fact that the consumer behavior, regulatory aspects, expectations, and the increasing volumes of behavioral data have created fierce competition amongst the BFSI industry as well.

It has been seen from ancient times that the people in the BFSI sectors have been the ones who have adopted the new technologies and reforms much faster than the other industries in the market. This can be seen in their internet-driven consumer engagements, marketing technologies, outreach technologies, and data security arrangements.

However, in today’s times, technology is easily available and accessible by all types of industries. Hence to engage and hook the new customers and increase the customer base, the BFSI industry as a whole needs to start thinking innovatively and bring out new reforms and ideas to the table.

It is time to take a break from the traditional methods of marketing and dive deep into the world of the new and modern marketing technology methods. However, these have their own set of challenges, but they are worth the pain considering the market in today’s times.

BFSI Marketers Guide – 3 Point Checklist

Here are the three essential points that you as a BFSI Marketer will need in your career to become successful. However, first one of the major things to keep in mind is that-

An Inactive customer is never loyal

The only thing that makes a customer loyal to your product or your company is the fact that they are constantly engaged with you and also that they have a positive disposition with the company. With this, let’s get to the three checkpoints that you will need as the BFSI Marketer to build a successful strategy to boost your marketing standards. The points are:

- Stop: If you still think of your industry as an inherently transactional one, you are wrong. The industry has changed, and drastic changes have been applied. These changes have made it very consumer-centric. This space revolves around the consumers and how you can manage their journeys.

- Understand: The next thing is to understand the behavior of the consumer. Additionally maintaining and nurturing a relationship with them is also important. Hence, for this, focusing on the consumer experiences with the help of technology should be achieved.

- Leverage: Increase your ROI by leveraging advanced data analytics and other innovations. Use as much technology as possible to your advantage.

Key Challenges for BFSI Marketers

Maintaining success in the BFSI industry in today’s time is a really tough job with its own challenges and difficulties. Here are a few challenges that the BFSI Marketers face in their journey:

- The Consumer View is Not Unified

Each and every industry including the BFSI industry is seeing disrupts. They can no longer deal sustainability in growth, and every organization is doing something to change the status quo or the trends in the market. The consumer has become well informed and technologically advanced, but in spite of this, they are also volatile and keep changing frequently.

The phenomenon called ‘consumer parallelism’ has become pretty evident in which the consumers create a complicated set of online and offline journeys. This, in turn, results in a gathering of an excessive amount of data from a variety of platforms which makes everything much more complicated and there is no clear path to make sense of it.

Still Not an User of Aritic PinPoint Automation?

In addition to all this, there are numerous departments in the BFSI industry. Each department differs in complexities and scales. This, then adding to the data that is received from the multiple vendors, makes it extremely challenging to have a unified consumer view by the marketer. This totally disrupts the objective of personalizing the offerings to the consumer since no appropriate conclusion can be made from their behavior.

- Inconsistency in User Experience

When companies make use of technology, the most important aspect is user engagement. Especially in the case of the BFSI industry, the most important factor is good user experience. So at times when there are technical difficulties that are inevitable, the consumers feel as if the connection has been broken and causes them to get frustrated and confused. This, in turn, creates a broken experience for the customer impacting customer satisfaction greatly. Because of this, the marketing efforts go futile, and there is a disjoint in the relationship.

If there is no data about these incidences, the marketers do not have any way to know or engage these consumers. Hence the solution for this is to create touchpoints at these places and make use of automation to take care of the customers. The automation can inform the customers or at least give them the answers about the small problems that they have been facing by the time all the technical difficulties are sorted out. Additionally, these touchpoints can also help the marketers in gaining more knowledge of the customer and their journey.

- Decrease In the CLTV (Consumer Life Time Value)

Consumers always want a smooth experience while banking with any company. They are like the driver, and your job is to provide them with a smooth road to reach their destination. This is the opportunity for you to engage the consumer and sell and resell your product by providing them with a good experience.

However as we discussed above, the marketers are unable to get a unified view of the consumer’s journey. This makes it really difficult for them to map their omnichannel hop. This, in turn, decreases the efficiency of the campaign, and the targeting of the customer and personalization are also affected. As a result of all of this, your company will miss out on the insights that are required in creating cross-sell opportunities. This means that the Customer Life Time Value is greatly reduced.

Why is integrated Marketing Automation Implementation needed in the BFSI Industry?

In the above section, we saw that there are a lot of challenges faced by the BFSI Marketers that need to be rectified in order to provide the consumer with the best experience and to bring more and more customers to the company. With these challenges in hand, there is an increasing need for Marketing Automation Implementation for any BFSI company. The reasons for this are as follows:

- There is no Actual Information About The 360-Degree View of The Customer’s Journey

As we have already been discussing one of the major challenges faced by the BFSI industries is not being able to get the appropriate information about the consumer and their journeys. Different consumers show different behaviors depending on the channels, platforms, and touchpoints they use. So, it is possible for the same customer to show different behaviors at different channels. As mentioned above, this is consumer parallelism and can make the job of a marketer even more complex. Hence, there is a huge need for the unification of the consumer data so that it can be decoded.

In order to accomplish this, the marketers have to get access to the most useful data. For this, a data specialist is required who can convert the channel data to summary-level data from the marketing ecosystem. This service is usually handled by a quality data integration service provider and, the in-house team cannot accomplish it.

The next step is linking the data sets to MAP which is the Marketing Automation Platform that gives a proper insight into the behavior of the consumer. After the end of this procedure, the marketer will have in his hand the unified view of the consumer data that can be used for multiple things such as segmentation, analytics, and much more. This is one of the most important steps towards personalization.

- The Consumer Experience Is Limiting

The BFSI industry is rapidly evolving to become a consumer-centric industry rather than the product-centric one. Hence the marketers are being faced with the challenges to keep a tab on the consumer’s preferences.

With the advancements, marketers have started to understand that marketing automation is the only step that has been missing from their full-proof plan. It is the only piece of the puzzle that streamlines measures and automates everything. The only thing that can provide a smooth customer experience is marketing automation.

Incorporating the right kind of integrated Marketing Automation Platform helps in identifying and aggregating customer behavior across all channels. This information is then used in customer nurturing. The most important thing is that it helps in providing a seamless customer interaction and experience by sending out the right message at the right time to the right customer through the right channel.

- Need To Increase Effectiveness Of Campaign Management

The repetitive manual tasks at the leading banks, mutual fund firms, and financial institutions take up the most time and human resources.

The cross-channel and Omni-channel journey builder is extremely efficient in increasing the efficiency and the ROI. The customers of the BFSI industry have the ability to switch services instantly. Hence it is the responsibility of the marketers to contact the consumers at the various touchpoints of their journey with personalized content.

All the cross-channel personal triggers such as the welcome emails, dividend declaration, and much more are really crucial in the communication. When these tasks are automated, they help in the enhancement of the Customer Lifecycle Program of the new leads.

The automated and properly designed workflow acts as a trigger to the relevant campaigns and also improves the conversions of numerous services and products.

Problems Faced While Implementing Marketing Automation

Everything comes with its difficulties and complications. Similarly, becoming digital in banking or other industries is not as simple as it seems. It is not just about the apps or the fancy websites. It is about making these platforms useful to the consumer and also providing them an excellent experience while using them. As a BFSI Marketer, you will always be under pressure to create the best of all the things that deliver results and also bring improvement to operational efficiency. Not only this, all of this should happen simultaneously while reducing the costs and expenditures. Here are some of the issues that can prove to be a hurdle in the Marketing Automation Platform implementation:

- Data Security

The BFSI industry has some of the most confidential data of the people. This data can be their bank and personal details. Hence going totally digital can be a big problem if they do not have a good data security system. Hence making sure that there is enough security is crucial.

- Lack of Expertise and Skills

The two departments namely the marketing and the IT have to work hand in hand in order to bring out the results from any marketing strategy in the company. However, the lack of skills and the lack of collaboration between these two departments can become a major setback for the marketers in executing the marketing strategies efficiently.

- Data Readiness and Quality

One of the major factors that Marketing Automation depends upon is the data. Hence no matter how technologically advanced Marketing Automation Provider you use, if the data you have collected is wrong or unorganized, you will never be able to obtain positive results.

Hence one of the major problems is the lack of structured and refined data that holds the marketers back from utilizing the MAP Platforms at their best.

- The Perfect Implementation Partner

The marketing automation implementation is just like the magic tool that can help marketers in reaching the desired goals with their customers. However, the tool cannot be used until a strategic implementation is done with the help of a reliable partner.

The implementation of the marketing automation platform can be a difficult task if the wrong digital delivery channel is chosen. This can limit the efficiency of customer engagement.

Hence it is very important for all the marketers to pick the right partner that can help them in choosing the right MAP and also implementing the perfect technology support and platform.

- Problems in Measuring ROI/Efficiency

The last problem that is faced while implementing a MAP is the problem in measuring the ROI and the efficiency. The biggest challenge is to measure the accurate performance and the results. Another challenge is to calculate the meaningful ROI metrics that are required in an organization. Hence for the organization to have successful MAP measurability of the results is one of the most important requirements.

Advantages of Marketing Automation Implementation in the BFSI Industry

After getting to know all the challenges that a person will have to face while using the Marketing Automation Platform, let us get to know the key advantages of Marketing Automation and its implementation. The biggest advantages are as follows:

- Getting the Unified View of the Consumer Journey

We have already discussed that getting the unified 360-degree view of the consumer journey has become one of the major challenges for marketers since the consumers are always on and their attention span is always spread across a variety of channels and devices.

Execute Effective Marketing Automation Workflows Now

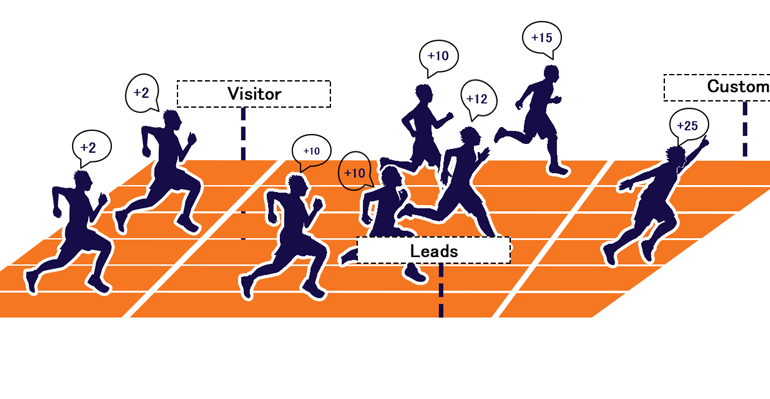

The basic concept is that each consumer wants to be understood as an individual. Hence they want the companies to understand that they have their own choices and needs. Getting up close and personal with the consumer has become important for every company and industry. Hence it is the responsibility of the marketers to talk to the consumer in a way that stays on track with their journey. Hence the storytelling has to be molded in a particular way. Hence it is important to understand that the leads are not just random leads but each of them is a different person with their unique needs who need different consumer experiences.

- Increase in The Customer Life Time Value

Another factor that makes the life of a marketer difficult is the decrease in the customer lifetime value. However, with the Marketing Automation Platform, this problem can also be solved. However, to retain the customers, the marketers need to make sure that the digital channels they use to contact the customers for lead nurturing are the right kind.

MAP is one such magic tool that can be used in planning multiple, integrated and simultaneous campaigns for cross-selling and up-selling. It has been proven that the MAP increases customer base improves conversations and also drives engagement.

- Advanced Segmentation

Another use of the MAP is that it helps in the building of multiple segments at various delivery channels. These segments can include emails, push notifications, SMS, web messaging, and in-app messaging. These allow you to reach out to a large customer base at a wide variety of channels depending on their history of usage and their activities.

Another advantage of the MAP is that it helps in building the payload-based segmentation. This provides you with the actual content that is consumed during any web or app activity by the consumer. Hence with this, you can target the customers on a variety of platforms depending on their purchase history, visited websites, and much more.

- Ease In The Real-Time Personalization

Every customer wants a personalized experience from the company. Hence for any consumer campaign to be successful, you need to personalize it for each and every user. Although this is not an easy task to accomplish, marketing automation can help companies in sending more real-time and personalized messages to consumers. This increases their transactions up to 5 times.

Since the BFSI industry is all about personal investments, there is a huge need for personalized communication through different channels. For example- a personalized email or a message or a product image can be triggered automatically just by the keywords entered by the customer. The financial securities companies can easily display the real-time price of the stock as the customer opens the email.

- On and Off-Site Engagement

Tools such as sticky bars and web push notifications are used by the marketers at the time when the users are either using the site or are just about to leave the site. This helps them in enabling real-time engagement and top-of-mind recall.

For offsite engagements, the Web Browser Push Notifications have been proven to be the most useful tools. As soon as the consumer visits the website, a message encouraging them to pick the push notification can be displayed on the screen. If they do opt for the push notification, you can easily interact with them through messages every time they access their browser. This is really helpful in improving the lead base as well as the number of subscribers. Additionally, this will also help you in receiving feedback on consumer purchases.

- Dropped Lead Recycling

There are a lot of leads generated by the BFSI companies that are dropped or not used anymore due to a variety of reasons. These leads can be recycled and used later. This is done by noting down the reason for the customers being dropped out and then bucketing them in a different segment. These segments can be then targeted with appropriate communication channels. There have been a lot of examples in which the banks have been able to convert the dropped leads into paying consumers.

BFSI Industry- Data Integration

We mentioned above that the most important thing about the MAP is the data. However, only data is not important in this age of omnichannel banking. What you need is smart data. Smart data means that the data can be used in some of the other forms effectively.

It is believed that by 2023 the most important skill of the digital leaders will be to work with the data successfully. So the new jump in the marketing industry will be from data deposits to the deployment of the data.

The best way to track a customer’s channel hop is by creating a partnership with the vendors that are known to you and your team. This can help you in getting all the smart data about the customers.

The major step that a marketer has to take in order to get their unified view of the customer and his journey is to get to know the marketing channel and the data sets along with the transaction data set by the customer. Thorough knowledge of all of this is important for any marketer. However, this can only be done if the data you have is ready to be consumed and is not unorganized.

One of the biggest concerns of the marketers in the BFSI industry is getting access to the data and ensuring its security. This is one thing that can come in the way of the seamless integration of the received data.

There are a lot of banks that leverage the APIs or the application program interfaces integrated with CRM, CMS, and CBS that can help the marketers in getting the data of the people in a controlled manner. Both parties have to sign contracts to ensure that no party is breaking any rules and regulations. This approach, however, has some risk involved with it and can get both parties into trouble. However, increasing the security can be a safety measure in ensuring the safety of the data.

The firewalls and limiting the MAP can also be used as a proper measure to tighten the security of the data. This is extremely important in minimizing all kinds of risks.

After this is done, the BFSI marketers need to unlock the next levels which is data analytics. Data analytics can cause a huge change in how the marketing and consumer interaction is affected if used correctly.

The integration of the demographics with the right transactional and behavioral data in addition to the best marketing automation tools can make the business strong enough to face all kinds of challenges.

Increase the ROI with the Analytics Solution

With the usage of the appropriate Marketing Analytic Platform, the marketer now has the unified view of the customer and also has all the data to take the next step. This next step is leveraging the data to reach their ROIs. Additionally, they also need to stay ahead of the competition and optimize the right kind of channels.

- Analytics is the best solution

As per an estimate, 68% of the banks have made an investment in analytics and are making huge profits with this decision. This means that with the right kind of analytics the company can reduce churn rates, facilitate the consumer with a better experience, boost cross-selling, forecast future trends, and also migrate the risks.

The question that arises is that how does the analytics achieve all of this?

To answer this question in simple words, the analytics provides the ‘Experiential Banking Experience.’

- Experiential Banking Experience

With the use of marketing analytics, the companies can determine the trails of the spending, preferred channels, and products. This is then used to map the metrics and create the likes and dislikes of each consumer, and then insight is made. This insight helps the marketer in taking swift actions.

The BFSI industry in today’s time has to not just extract the volume of the data but also to deploy the extracted data at relevant places.

The scope of marketing analytics and customer integration is huge in the BFSI industry. The customer integration is helpful in giving an insight into the behavior of the customer whereas marketing analytics can be used to compare and measure the performance of the activities done. Meaning the revenue earned is compared to the money spent and the profit is taken out.

Joining both the marketing analytics and the customer integration is an important step in connecting all the touchpoints on their way to analytics and data-driven marketing.

Integrated Marketing Analytics Model in A Nutshell

Merging the marketing analytics with customer transactional analytics is the best way for the marketers to get the single data that is true and effective. The basic motive is to increase the cross-sell and up-sell conversions and to reduce the churn. There is much different analytics that we will be discussed below:

- Customer Analytics- Predictive Analytics

Predictive analytics is the type of customer analytics that helps marketers or banks to identify high-value customers. These customers are then provided with special customized products and services from the company and a variety of advantages are given to them at the various stages of the customer cycle.

The behaviors or the potential and the existing customers can be identified using the predictive model. This is done by keeping a tab of their behavioral patterns. The cross-selling models are effective in realizing the cross-sell opportunities. These models include:

- Cross-sell and Lapsational Models

- Predictive Churn Model

- Recommendation Engines.

- Marketing Analytics

The statistical approach to analytics is the Marketing Mix Modeling. This analysis is important in determining the impact of the marketing techniques that are used in the offline and online channels. With this, the marketers can have a better understanding of the market and can easily fine-tune their marketing mix. The two major factors in the marketing analysis are the

- Funnel Tracking

- Channel Attribution Analysis

- Customer Analytics-Descriptive Analytics

Descriptive analytics is the type of analytics that helps the marketers in gaining the summary of the events that can help in the determination of the future activities of the customers and their outcomes. These summaries can be used efficiently to re-target the customers with the help of some important cues. With the help of all the data, the retargeting of the customers becomes simpler.

The marketers can also group the customers into a variety of segments and bring out better results by targeting each segment differently. The various types of segments are as follows:

- Behavioral segmentation

In the behavioral; segmentation the consumers are grouped according to their behavior and response to the products and the services.

- Value-based Segmentation

In the value-based segmentation, the customers are grouped on the basis of their past transactions and the business they have already done with the company.

What Does The Future Of The Analytics Model Hold?

Coming to the end of this discussion, let’s try to find out what the future of the BFSI Marketers looks like? The customers are becoming more tech-savvy with time. This is leading the companies to invest more and more in Research and development to create faster, smarter, and much more intuitive products.

Machine learning and artificial intelligence are two of the major technologies that are being considered as the future of marketing tech companies. With machine learning and artificial intelligence, the process of maintaining the customer relationship becomes much easier, and the things such as chatbots, talk assistants, and smart voice assistants can make this process easier. These will require minimal supervision and can be used to advise the customers on all their problems. Both these technologies can also be used in the segmentation and analysis of multiple data. This can be helpful in boosting the engagement a hence the conversion rates.

No matter what technology is used in the future and the present, the most important thing right now and in the future is the data. Hence the assumption of the data in every marketing level is the next strategy for the companies. The data that is extracted and used in the various analytical models are the core of the companies’ marketing policy and is the reason for their overall success.

⭐ What is the customer activation strategy?

The customer activation strategy encourages customers with detailed analytics to move to the next level of their customer’s life cycle.

⭐ What is an activated consumer?

Customer activation motivates shoppers to take advantage of the benefits of the product and fosters brand engagement with the next generation of customers.

⭐ What is loyalty customer?

A loyal customer is a customer that, over time, has developed an emotional connection to the brand. For this to happen, they need to be given more value at any point of contact.

⭐ How content strategy and dynamic segmentation are interrelated?

In the absence of dynamic segmentation, marketers cannot develop a content strategy to engage audiences. They need to know the targeted audiences for constantly creating relevant content & strengthening customer relationships.

⭐ Can I increase my ROI through dynamic segment?

Marketers must create a workflow to deliver relevant messages based on dynamic segmentation, and this enhances the ROI of marketing campaigns.

⭐ What is predictive segmentation?

Predictive segmentation is the process of grouping people into segments based on a higher likelihood of their anticipated future behavior.

⭐ What is B2B marketing automation?

B2B marketing automation is a process that uses software to automate repetitive tasks within the B2B marketing funnel. It helps businesses to manage and track lead generation, sales campaign and communications across all digital channels.

⭐ What is the future of marketing automation?

According to some industry analysts, we can expect to see a shift towards predictive and prescriptive analytics as to the next generation of marketing automation evolves.

11 Comments

Great post! This piece of information is an eye-opener for many budding marketers who are unaware of the BFSI revolution.

The Banking, Financial Services, and Insurance (BFSI) sector had to introduce digitalization. All marketers should have this knowledge. Everyone should be updated on how we have progressed in these sectors as well, this article does just that.

Integrated Marketing automation communication promotes efficiency across the board and prevents unnecessary duplication of information due to the delayed record-keeping process. The articles in the post give a clear picture of the marketing automation strategy.

Thanks a lot, Ankit. It was awesome to read the article as it gave me a clear picture of the marketing automation strategy.

It was an informative blog since it provides valuable information on BFSI revolution. Thanks a lot for updating it.

Great article Ankit! It’s proven the fact that only when you can understand the customers well, then the deliverability issues can be resolved.

Thanks, Ankit for updating the BFSI Marketers Guide for integrated marketing automation communication. I got a clear idea.

Well-written blog! Ankit, it was an informative blog about marketing automation strategy.

Awesome work! Ankit. Great updates about the BFSI Marketers Guide for integrated marketing automation communication.

Awesome work! Ankit. Great updates about the BFSI Marketers Guide for integrated marketing automation communication.

Automating your marketing with integrated marketing automation, analytics, and communication is just about affordable at the moment, I believe.