Marketing Automation For Banking

Marketing Automation For Banking

Get detailed insight into the lifecycle of each of your customers, right from the time they visit your bank's website, to getting converted into a potential lead and then loyal customers. Redirect your marketing campaigns towards maximizing your ROI with Aritic PinPoint. Identify the best marketing channel, optimum marketing message frequency, and all the available resources to build a unified customer experience. Monitor and create rich customer profiles to target and retarget them with relevant educational content, ads, and offers.

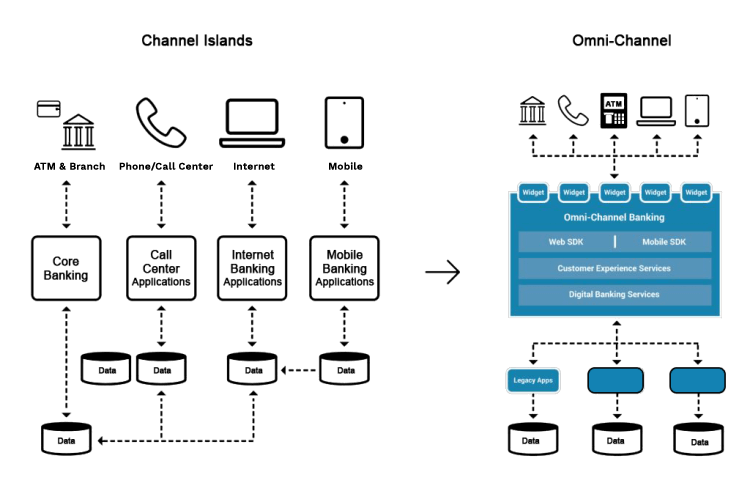

Use unified customer profiling for omnichannel customer engagement

Online banking across the globe is increasing swiftly. Your customers are using mobile apps and desktops to handle their banking-related issues. Are you ready for your customers then? Connect with your customers across multiple marketing channels and offer a consistent banking experience. With unified lead profiling, put all customer-information in one place tied to each other. Create lead-specific marketing messages to automate your customers’ buying journey.

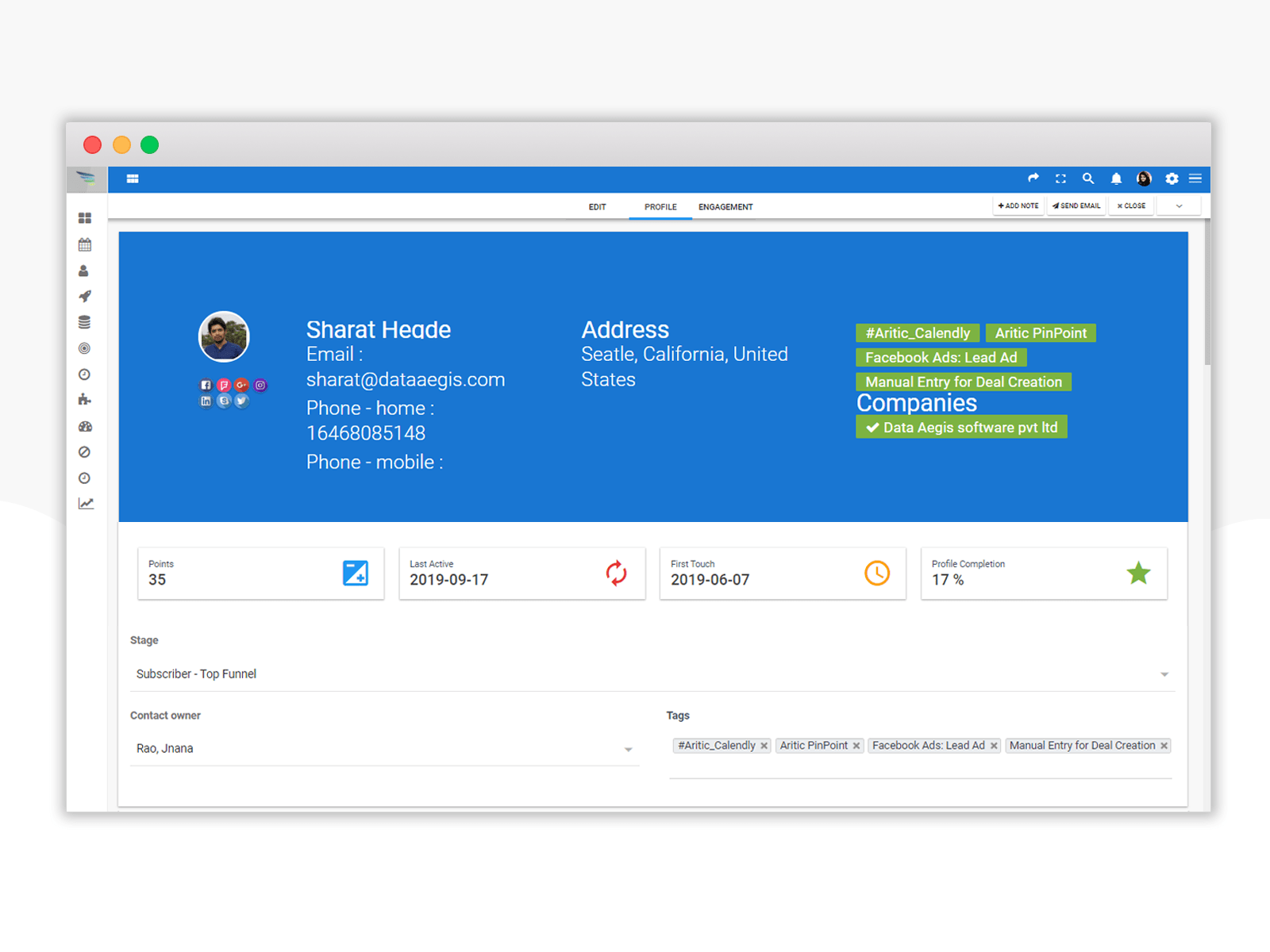

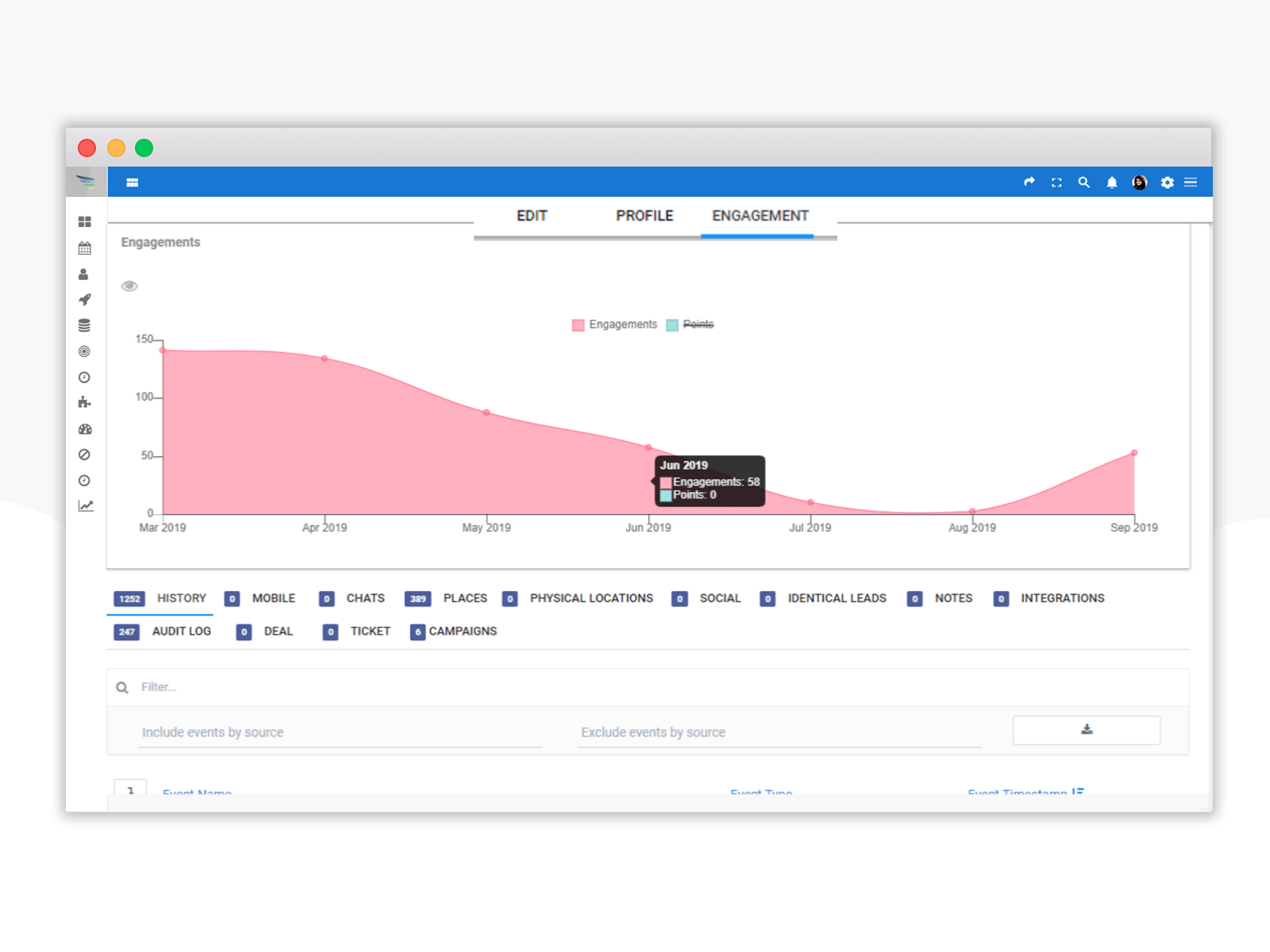

Rich customer profile for better targeting

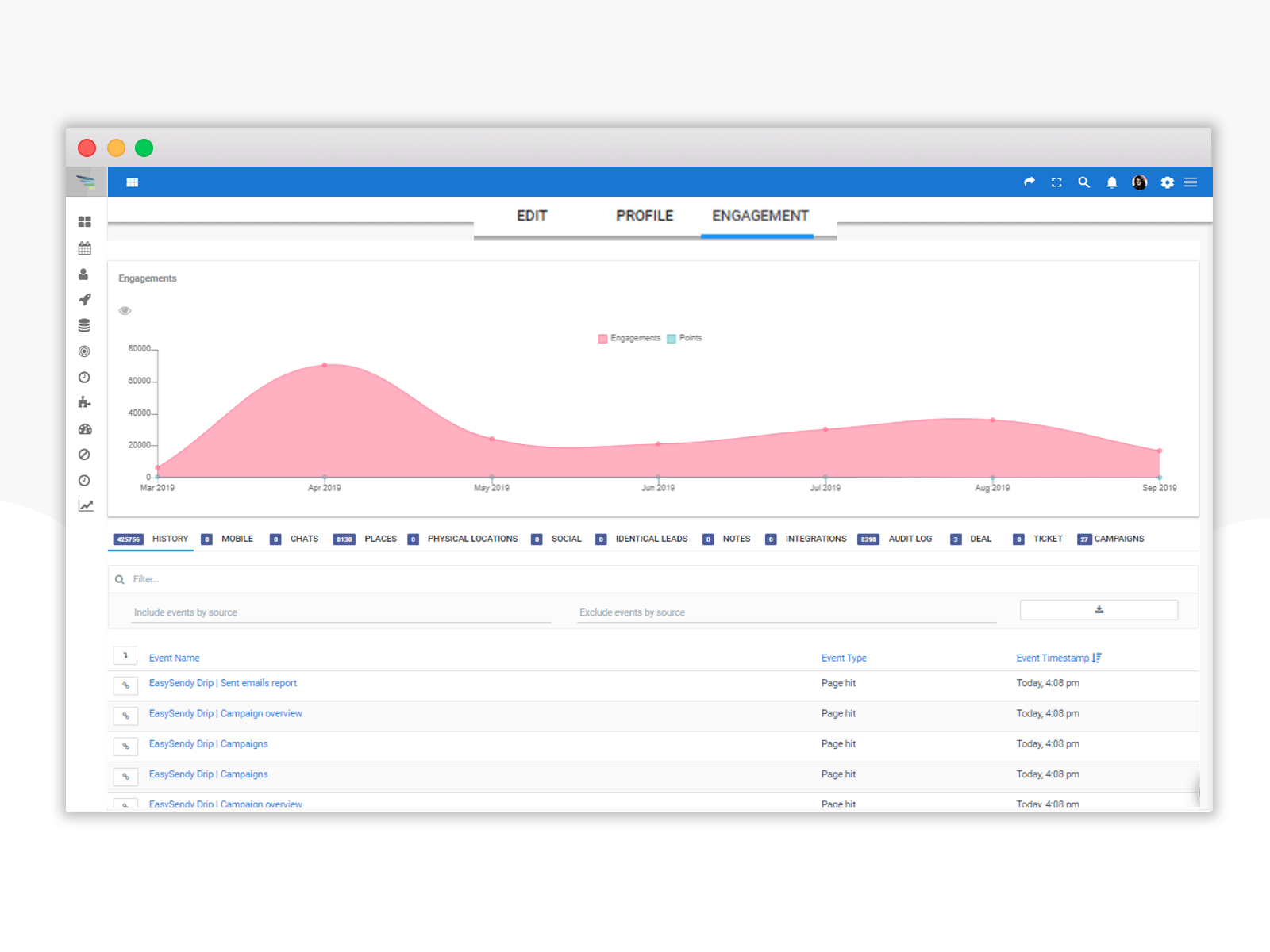

It is essential for you to provide tailor-made offers to each of your customers. Create rich customer profiles that resonate your customers, monitor their web and in-app behavior, and create marketing campaigns that to their interests and preferences.

360 degree customer overview

Profile your customers based on various data sources like social media profiles, demographics, job profile, family structure, account balance, and behavioral tracking. Use dynamic segmentation of Aritic PinPoint to segment your customers based on events, behavior, demographics, and buyer’s stage.

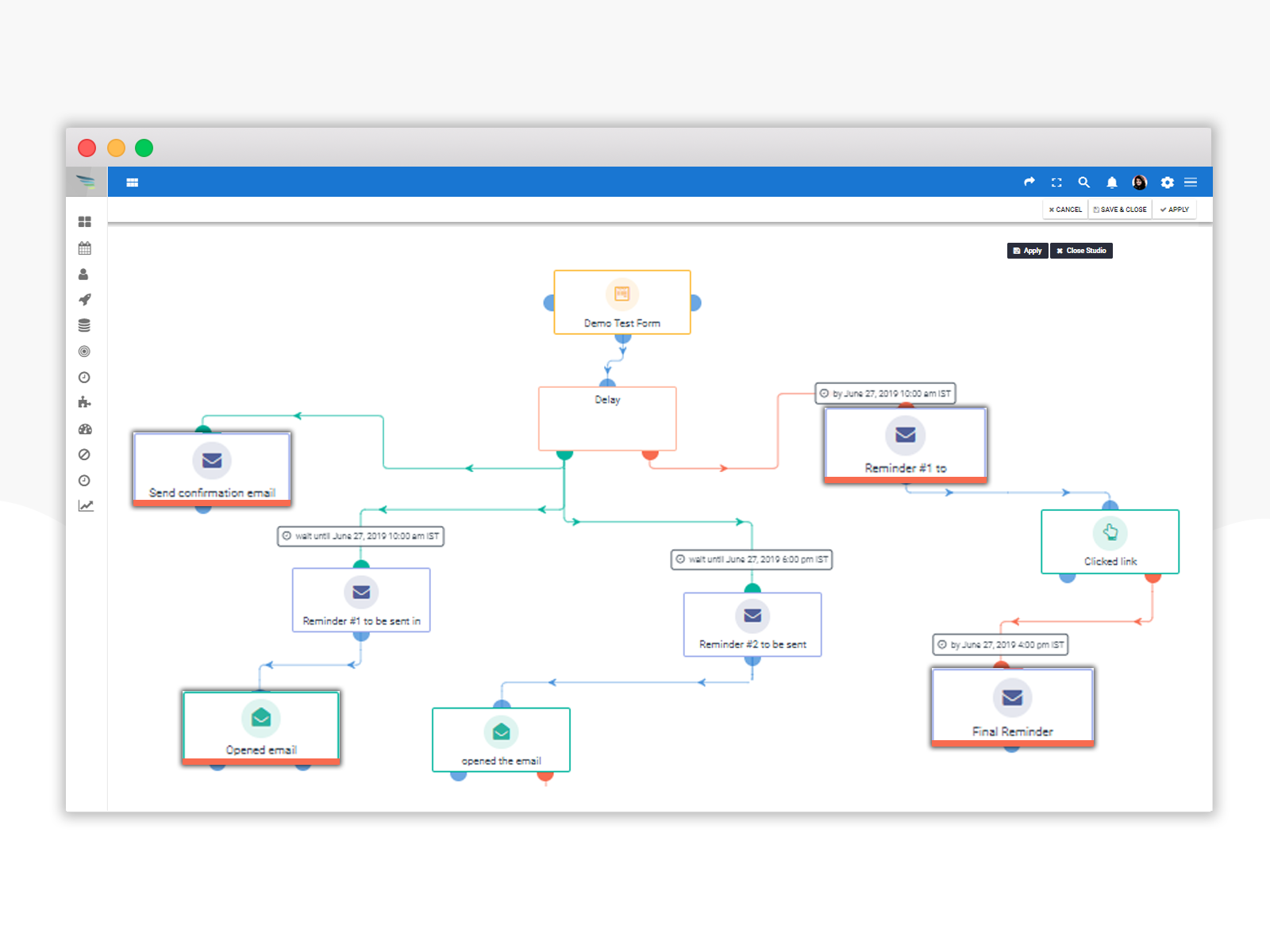

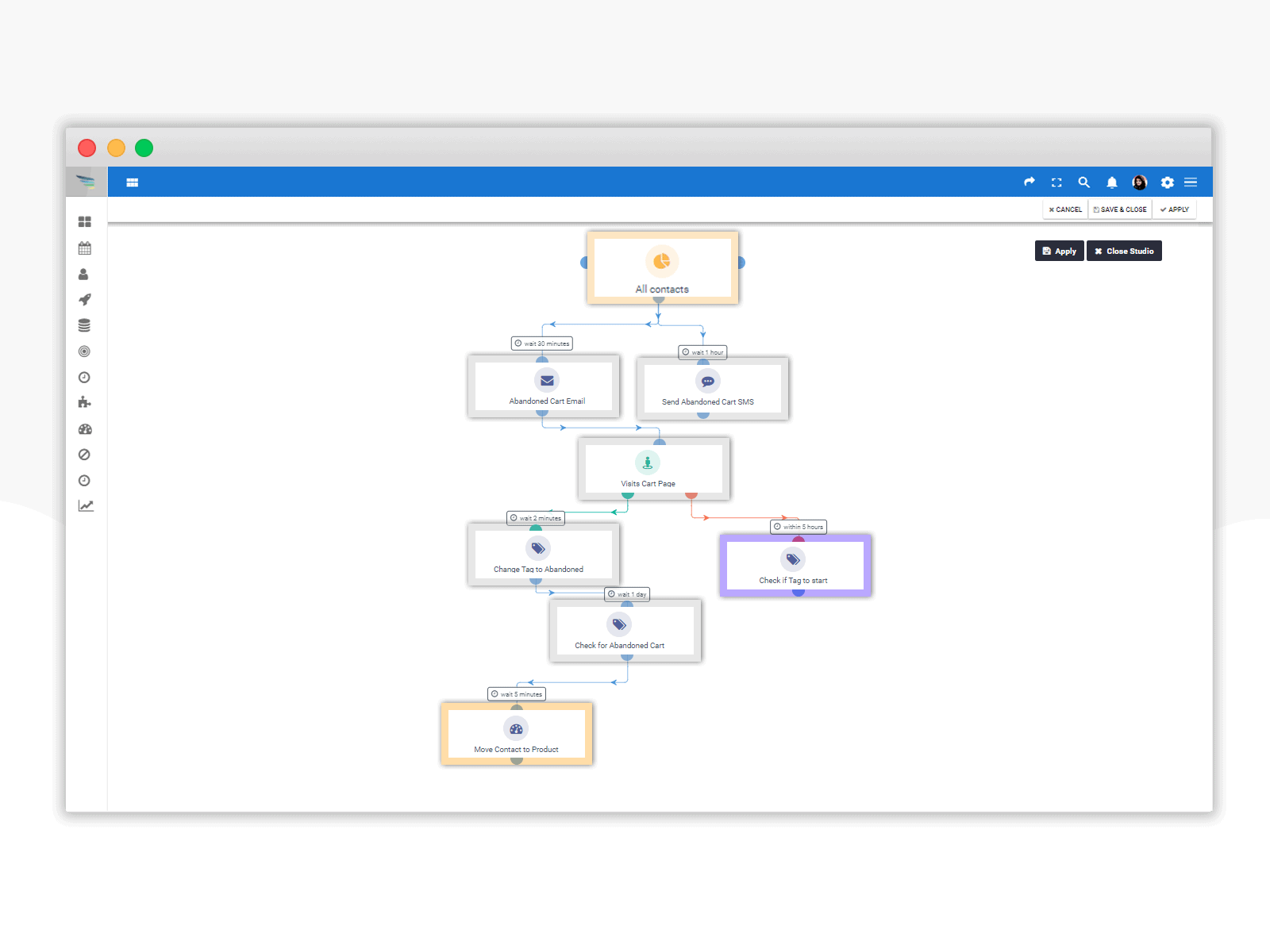

Get started with smart digital banking system

Create a unified banking system that is smart, intuitive as well as transparent. Use easy drag and drop editor to customize your landing pages, email templates, and other marketing templates. Create drip campaigns across web and mobiles, manage your marketing assets.

Make your banking experience digitally smart today.

Omni-channel Automation Solution

Aritic PinPoint offers an omnichannel customer experience to help you streamline all your customer conversations across multiple marketing channels, like web, front-office, mobile, call center, etc. Create your own marketing assets.

Secured IT infrastructure

Starting with web activities to mobile browsing/in-app browsing, track your customers’ entire digital journey. Analyse their transactional behavior to identify their current location, map nearby ATM and bank branches for them. Dig in deep into your marketing automation campaigns to improve it.

Geolocation fencing campaigns

Set a geo-boundary and trigger alerts as and when any of customers leave or enter that fencing. Automate triggers and campaigns based on such activities. Set automated reminders for your customers who are yet to finish their KYC submissions.

Grow your clientele with our comprehensive marketing automation features

Target. Acquire. Nurture. Convert. Delight.

Multi-channel marketing campaigns

Leverage every marketing and sales channel to build a unique and consistent customer experience for your brand

OmniChannel Marketing Automation Experience

Create a smooth transition from one device to another or from one channel to another for a unique customer experience

Mobile optimized marketing campaigns

Use ready-to-customize responsive templates for your marketing automation campaigns to target mobile-only users

Over 2,500+ customers trust Aritic

The world's most innovative platforms are growing with Aritic. Connect with us.

Want to Improve ROI?

Big or small, we have marketing automation features tailored for your business

Related Blogs

Blog on Marketing, Sales and Customer Support Management

Lead nurturing with Automation

Email marketing automation and marketing automation are not same, nor are complementary terms. Understand the difference for more clarity.

Email V/s Marketing Automation

With Proper segmentation and marketing automation campaigns, effective lead nurturing can be done. Learn 9 different ways to generate leads.

Marketing-sales alignment

Marketing-sales alignment can increase revenue by 208%. Learn the To-Do's of 'Smarketing' before starting with marketing automation strategy.